State tax return estimator

Up to 10 cash back Estimate your 2021 - 2022 federal tax refund for free with TaxSlayers tax refund calculator. Calculate your refund fast and easy with our tax refund estimator.

Tax Year 2022 Calculator Estimate Your Refund And Taxes

This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax.

. Filed your 2020 tax return by October 15 2021. Meet the California adjusted gross income CA AGI limits described on the Middle Class. This Tax Return and Refund Estimator is currently based on 2022 tax tables.

Short-term capital gains which are realized in less than a. 2019 Individual Income Tax Estimator 2020 Skip to main content. 2021 Personal income tax calculator.

- Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and. This calculator is for 2022 Tax Returns due in 2023. Our Premium Calculator Includes.

Do not use periods or commas. Prepare and e-File your. Filed your 2020 tax.

W-4 Adjust - Create A W-4 Tax Return based. To estimate your tax return for 202223 please select the 2022 tax year. It will be updated with 2023 tax year data as soon the data is available from the IRS.

The individual income tax estimator helps taxpayers estimate their North Carolina individual income tax liability. Estimate my payment amount. Estimate your payment amount.

You are eligible for the Middle Class Tax Refund if you. We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes. W-4 Pro Select Tax Year 2022.

PAYucator - Paycheck W-4 Calculator. Enter your taxable income from Form OR-40 line 19. RATEucator - Income Brackets Rates.

We offer free customer support to everyone filing a current or prior year tax return from 2008-2019. The New York State Deferred Compensation Plan is a State-sponsored employee benefit for State employees and employees of participating employers. You can quickly estimate your Maryland State Tax and Federal Tax by selecting the tax year your filing status Gross.

Use this tool to find out what you may qualify to receive. Capital gains in those categories are included as taxable income on the Massachusetts income tax return. You are eligible if you.

How To Calculate Taxable Income H R Block

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

Indiana Income Tax Calculator Smartasset

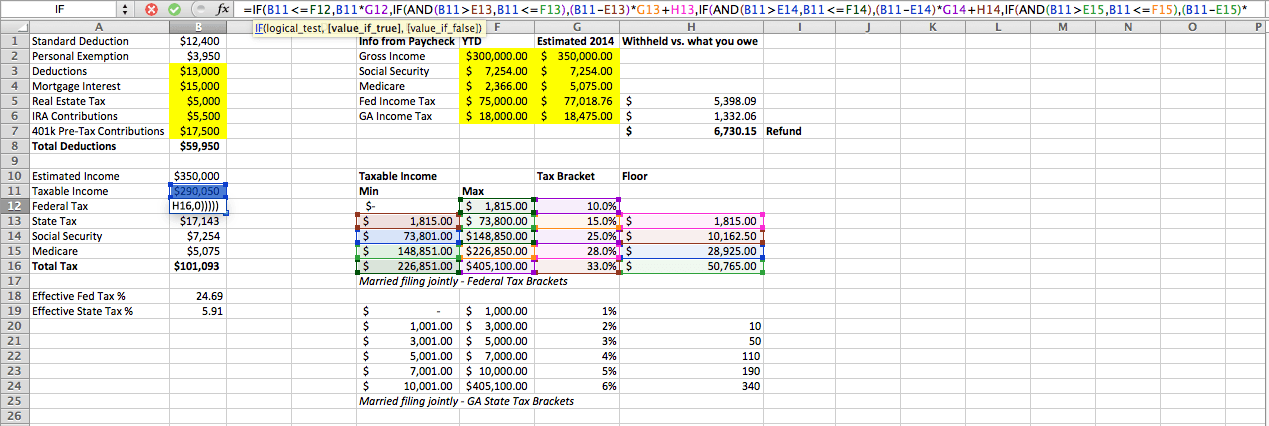

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To Calculate Income Tax In Excel

Excel Formula Income Tax Bracket Calculation Exceljet

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To Calculate Income Tax In Excel

How To Calculate Federal Income Tax

Excel Formula Income Tax Bracket Calculation Exceljet

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet

Tax Return Calculator How Much Will You Get Back In Taxes Tips

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor